Ukraine defends its land against Russia's aggressive war. As lawyers, our first priority is to bring Russia to justice.

WE WIN CASES WE CLOSE DEALS

About

Us

Ulysses is an independent law firm based in Ukraine. Specializing in Disputes (Arbitration and Alternative Dispute Resolution, Complex Litigation, Investor-State Disputes, and Public International Law) and Transactions (Banking & Finance, Corporate and M&A, and Taxation), Ulysses helps Clients to win disputes (usually involving high-stake public policy issues) and close deals through the interaction of public international law, national laws, and public affairs.

EXPLORE OUR CASES AND PROJECTS PROTECTING CLIENTS AND CREATING VALUE

Our

Clients

We value our clients

reliable and trusted lawyers

Our

Teams

Andrii Gusak

Partner, Disputes

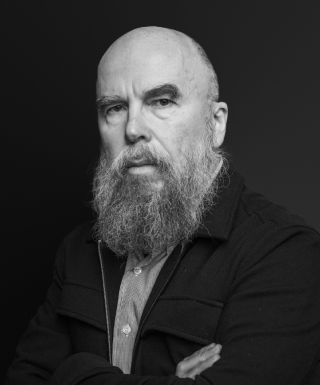

Valery Fedichin

Of counsel, Disputes

Arseniy Herasymiv

Attorney-at-law, Disputes